With all the uncertainty lately about the Coronavirus, it is understandable that you may be asking what’s next. Will events like the Coronavirus have an impact on you being able to reach your personal and financial goals? Money isn’t the most important thing in life, but it does help you to accomplish some goals. Part of the burden is trying to sort through the news cycle to determine 1) what applies to your situation and 2) what you can control. My aim in this article is to help you to better understand both the current market environment and the threat the Coronavirus could pose to your portfolio. But keep in mind that this is no substitute for actually sitting down, identifying your goals, and developing a plan to achieve them! Financial planning should inform your investment decisions, not the other way around.

Market Sentiment

Investor Optimism

Monday, January 27th, was an important day in the market. It marked the end of a remarkable streak of calm in the S&P 500. The loss ended one of the S&P’s longest ever streaks-73 days- without a daily change of more than 1% in either direction.

It also marked the end of the 30 session streak, where the S&P 500 had not had back-to-back losses.

I mention these two statistics because I believe it is essential to understand the greater context of the market environment in which you are investing. As of late, investor optimism has reached the point of extreme bullishness. Historically, this is a bearish signal, at least in the short-term, for the overall stock market.

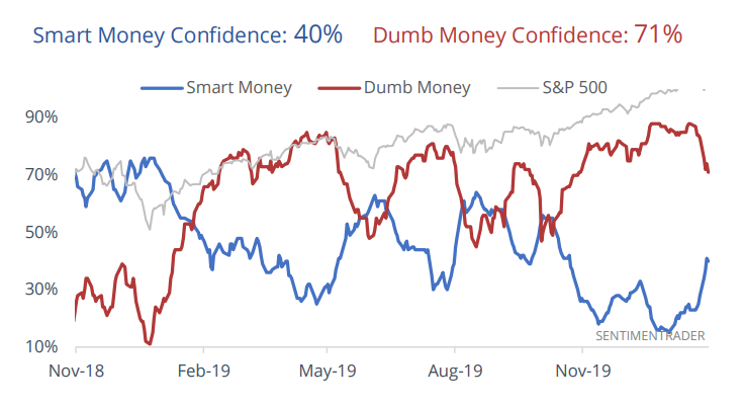

Smart vs. Dumb Money

One of my favorite investor sentiment indicators is the Smart Money and Dumb Money Confidence Index.

It shows what two different groups of investors are doing. The “smart” money is large commercial hedgers, institutional traders, or speculators. The “dumb” money is the smaller odd-lot traders or speculators. Two weeks ago, we were at one of the most extreme sentiment windows in 20 years. It was something quite out of the ordinary.

When things become this stretched, we typically will experience a reversion to the mean in optimism and market returns. But there always must be a catalyst. I believe there is a reasonable chance that we may have just experienced it.

The Catalyst

Wuhan and Corona

In mid-January, major news outlets began to report about the spread of a disease of the coronavirus family of viruses in Wuhan City, China. The first case of Coronavirus (2019-nCov) was first reported to the WHO (World Health Organization) on December 31st.

Is It Comparable to SARS?

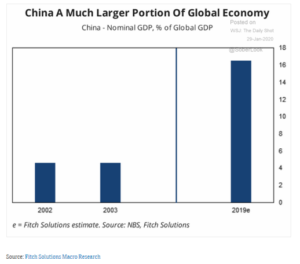

The news media has made comparisons to the Severe Acute Respiratory Syndrome (SARS), another virus in the corona family that appeared in China in 2002.

SARS infected 8,096 people over 9 months from 2002 to 2003. Over the last month, almost 20,000 individuals have been diagnosed with the Coronavirus. That is a dramatic difference, but it is critical to remember that SARS had a fatality rate of 9.5% compared to the current fatality rate of 2.2%.

One of the most significant differences between now and then is that in 2003 only 6% of the Chinese population had access to the internet. That number has increased tenfold to more than 61%. The hope is that awareness will help to slow the further transmission of the virus.

3 Ways the Coronavirus Could Impact the Market

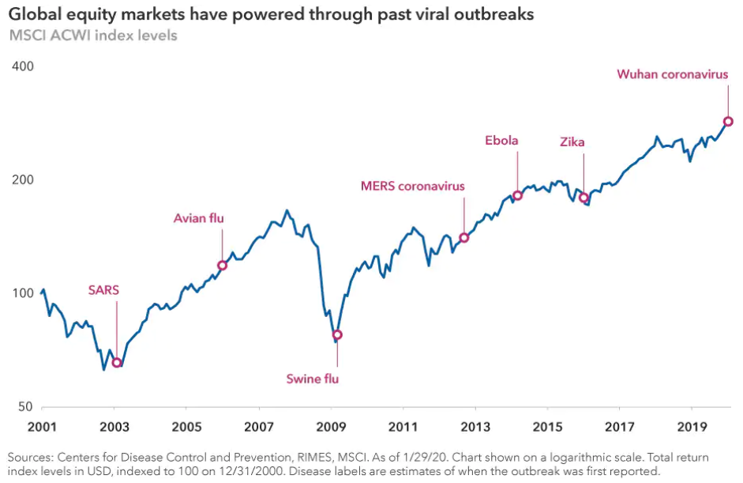

Based on the numbers coming out of the Chinese government, many economists and financial institutions believe that the U.S. economy is strong enough to weather any economic impact related to the Coronavirus. Any economic impact will only be temporary. They point to prior past viral outbreaks.

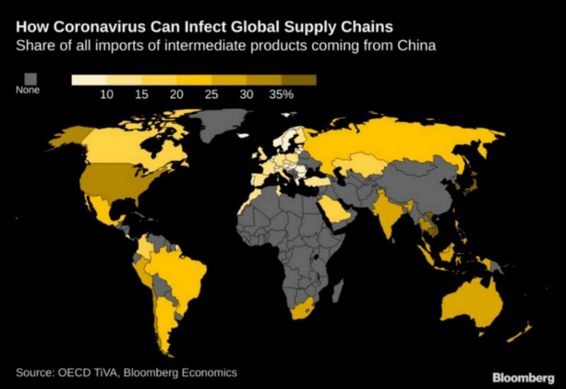

Although the market could be looking past the economic impact of the Coronavirus, there are a few things that could cause the market to reassess this assumption.