Does it seem like your medical expenses are increasing at a faster rate than your pay? An HSA or FSA offered through your employer could be a way to help offset the difference. The additional tax savings could help you handle unexpected expenses or even help you save towards a financial goal.

Double or Even Triple Tax Savings

Both HSAs and FSAs allow for multiple tax breaks on qualified medical expenses. And either you or your employer can make contributions to these accounts. The contributions you make will be either excluded from income (FSA) or tax deductible (HSA) and your employer’s contributions will be treated the same. When it comes time to pull out money for qualified medical expenses, the funds are also tax free. Most HSAs offer a savings option and some even allow you to invest in the market. In the case of HSAs, any growth is tax free. When it comes to HSAs and FSAs, the IRS cuts you break on taxes up to three times. So if you pass up this opportunity, you could be missing out on potential savings.

A Choice Between Two Good Options

Which one is better? The better question is which one is the best fit for your needs? That depends on your situation. The first step is to have a good understanding of where you are at with your healthcare coverage and needs. Once you’ve done that you can better understand the differences and figure out which solution best fits your needs.

Who Can Open an HSA

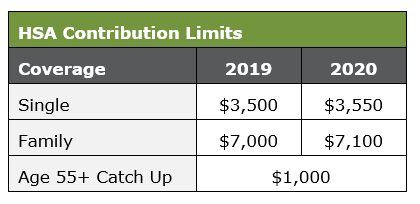

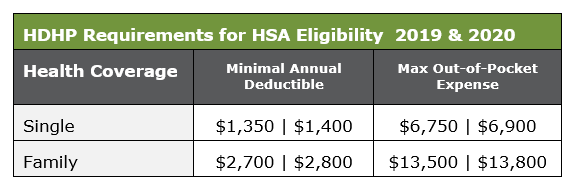

Health Savings Accounts, otherwise known as HSAs, require that you are enrolled in a High Deductible Health Plan (HDHP). It is important to remember that HSAs are not health insurance. They are accounts in addition to your health insurance. HSA eligibility is primarily determined by your level of healthcare coverage. The table below outlines the minimum annual deductibles and maximum out-of-pocket expenses that are required in order to have to HSA.

There are a few other requirements to have an HSA. First, you cannot be currently enrolled in Medicare. You also cannot be claimed as a dependent on someone else’s return. Finally, you cannot have any additional health coverage. Except in a few limited cases you cannot open an HSA if you or your spouse have an FSA.

Need help trying to figure out whether or not you can contribute to an HSA? Download Hedgefield Wealth Management’s Flowchart

“Can I Make A Deductible Contribution to My HSA?”

Where to Open an HSA

As noted above, an HSA is an account separate from your health insurance. Many employers will open an HSA account for you. Remember, you own the account not your employer. This is important because any balance rolls over from one year to the next. And if you quit, you keep the account.

Although an employer can open an HSA on your behalf, you are not required to set up an HSA through your employer. As long as you have an HDHP, you can set up an HSA through any institution that offers an HSA. Some people may go this route if their employer doesn’t offer a Section 125 Plan (cafeteria plan) or an investment option. But if you chose to go this route, you’ll be responsible for making contributions yourself. There is also the chance that you may be missing out on a payroll tax deduction.

How to Use an HSA

HSAs can be used to reimburse previously incurred or to pay for current qualifying medical expenses. If you are reimbursing previously incurred medical expenses, the HSA must have been in existence (opened) when expenses were incurred. But there is no requirement that expense must be reimbursed immediately, so keep good records. This could give your HSA funds additional time to grow.

How Not to Use an HSA

There are a couple of possible penalties you will want to be sure to avoid. If you take out any amount for non-qualified medical expenses before age 65, you will be taxed on the withdrawal and incur a 20% penalty. The two exceptions to the 20% penalty are if you are disabled or dead. However, after age 65, you can take out any amount. But it will be taxable if it is not used for qualified medical expenses.

Finally, HSA funds cannot typically be used to pay for insurance premiums. The only exceptions are if they pay for COBRA premiums, a portion of long-term care premiums, or Medicare premiums (not Medigap).

Who Can Open an FSA

Flexible Spending Accounts (FSAs) are different from HSAs in that they don’t require that you have any type of health insurance. The only requirements are that you are under 65 years old and employed. If you don’t have traditional healthcare coverage–you are self insured or part of a healthcare cost sharing ministry–then the FSA might be a good option for you.

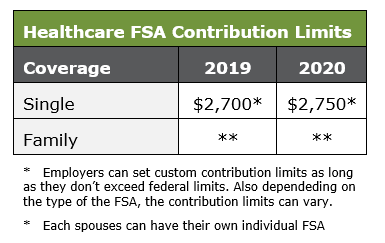

FSAs are administered by employers. Although this article deals primarily with healthcare FSAs, employers can offer employees up to three different types of FSA plans:

Healthcare FSA– Can be used for qualified medical, pharmacy, dental and vision expenses. These are the most common types of FSAs.

Dependent Care FSA– Can be used for qualified daycare, elder care, preschool, and day camp expenses. This type of FSA is great for employees who take care of dependents under the age of 13 years old and/or adults who can’t mentally or physically care for themselves.

Limited Purpose FSA– Can be used for qualified dental and vision expenses before you meet your deductible. Then after you meet your deductible you can use it for medical expenses. If available, this FSA can be paired with a HSA.

If you do change or leave your job, you will forfeit any remaining FSA balance. But if you’ve already spent your annual limit, you will not be responsible for any amount that is yet to be withdrawn from future paychecks. You may even have the ability to open another FSA with your new employer during the same tax year.One thing unique to FSAs is that you immediately have access to the annual contribution limit even if the account isn’t fully funded. Effectively you can loan yourself the money in an FSA account and pay it back over the course of a year. For this reason, you are not allowed to change how much you contribute throughout the year. You cannot make changes to your contribution amounts until the start of the next plan year.

How to Use a FSA

Remember FSAs are “use it or lose it” accounts. If you don’t use all the funds by the end of the plan year, any remaining balance goes back to your employer. However, some employers do allow a 2-3 month grace period. And some employers will allow you to rollover up to $500 to the next year plan year. But both of these are up to the discretion of the employer.

How Not to Use a FSA

Early or non-qualified withdrawals are not allowed. Some FSAs do provide debit cards that allow you to pay for expenses as incurred. Other employers will reimburse you by adding the amounts to future paychecks after you have submitted the expenses for review. More than likely non-qualified expenses will not be reimbursed. In situations where each spouse has their own FSA, only one FSA can be used to reimburse a healthcare expense. And unlike the HSA, a FSA cannot be used to pay for COBRA insurance premiums, long-term care premiums or Medicare premiums.

Summary

Trying to figure out all the differences between HSAs and FSAs can initially seem overwhelming. To help figure out which option is best for you, ask yourself these questions:

- How much can/will you set aside for medical expenses each year?

- Are you currently enrolled in an eligible healthcare plan?

- What options does your employer offer?

- Do you qualify for a HSA or FSA?

By understanding your own healthcare needs and your available options, you will be better equipped to take the next step to potentially save on your healthcare costs so that you can spend more on the things that matter most.

Click here to learn more about how Hedgefield Wealth Management can help to remove the burden of managing your wealth.

Hedgefield Wealth Management is a registered investment adviser. Hedgefield Wealth Management does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Sources:

https://www.moneycrashers.com/flexible-spending-account-fsa-rules/

https://www.bcbsm.com/index/health-insurance-help/faqs/plan-types/health-spending-accounts/fsa.html

https://www.depositaccounts.com/blog/flexible-spending-account.html

https://www.investopedia.com/insurance/hsa-vs-fsa/

https://www.betterment.com/resources/truth-about-hsas-and-retirement/