On March 27th, 2020, President Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2 trillion emergency financial aid package. The legislation was designed to provide immediate relief to individuals impacted by the Coronavirus. The bill has several different components to it. Hopefully, this article will help to familiarize you with some of the more notable provisions. My goal is for you to understand the impact that the CARES Act will have on you and your family.

Economic Impact Payments (EIPs)

This is probably the one portion of the CARES Act that applies to most people. The EIPs are the checks that the government is sending out to individuals. Remember, the goal was to provide immediate financial relief to individuals that were impacted by the Coronavirus. The keyword here is “immediate.” Unfortunately, that means that accuracy, at least in some cases, was sacrificed for speed. There are already reports of deceased individuals receiving checks.

Will You Get a Check? How Much Will It Be?

The two questions that everyone seems to have when it comes to these checks are, “Do I get a check?” and “How much will it be?” Before I answer those questions, you need to understand what this check is. The EIPs are a credit against your 2020 tax liability. Think of it in these terms. Too much was withheld from your paycheck, and now the government is sending you a refund. Just like your tax refund, this payment is not taxable.

Who is Eligible for the Credit?

This is where we go back to the issue of sacrificing accuracy for speed. Because not everyone had filed their tax returns for 2019, the government decided to use whichever tax return you filed last. If you have already filed for 2019, they used that return to determine your eligibility. Otherwise, they used your tax return from 2018.

Now, I am going to answer both of the earlier posed questions at the same time. I think that it is easier that way. Imagine everyone starts with a payment of $1,200. Married couples would begin with $2,400, individuals filing single or as head-of-household $1,200. Each qualifying child would result in an additional $500. Note that it must be a qualifying child, which the IRS defines as a dependent under the age of 17 on December 31st, 2020. If you are claimed as a dependent, in 2020, of someone else and over the age of 17, you are not eligible for EIP.

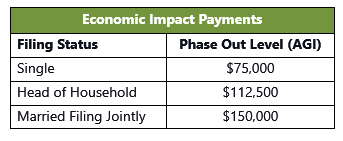

Phase-Out Limits

The next step is to apply the phase-out for each type of taxpayer. For every $100 that the taxpayer is over the phase-out limit, their EIP is reduced by $5. The upper limit on Adjusted Gross Income (AGI) is fairly straightforward if you don’t have a qualifying child. If you are single without a qualifying child, you will not receive an EIP if your AGI is greater than $99,000. Those who are married without a qualifying child will not receive an EIP if their AGI is greater than $198,000.

How Kids Change the Equation

For parents with a qualifying child, the upper limit depends on the number of children in your family. Let’s use my family as an example. My wife and I are eligible to receive $2,400. We have four children under the age of 17, which means we are eligible to receive an additional $2,000—$500 for each child. The total amount of our EIP would be $4,400. If our AGI is $100,000, we will receive the full amount.

But what if we made more than the phase-out limit? Let’s say our AGI is $175,000. The amount we are over the threshold is $25,000 ($175,000-$150,000=$25,000). We would then determine that $100 goes into $25,000 twenty-five times ($25,000 / $100 = 25). So, the EIP for our family would be reduced by $1,250 (25 x $5 = $1,250). In this example, our family would receive an EIP until our AGI exceeded $238,000.

How Will I Get the Money?

How Will I Get the Money?

It depends. If you included a bank account on your 2018 or 2019 tax returns, the Treasury Department would send your EIP by direct deposit to that bank account. But what if you didn’t include a bank account on your return? Or your bank account information has changed? For those already receiving Social Security, the Treasury Department will send your EIP to the same account as your Social Security benefit. For everyone else, the Treasury will send a paper check to the last address on file with the IRS.

How Long Will It Take?

Congress has instructed the IRS to get the checks out as soon as possible. For those individuals that have a bank account on file already with the IRS, the first checks began to hit bank accounts on April 10th. If you want to check the status of your EIP, you can use the IRS’s “Get My Payment” tool.

Get Hedgefield Wealth Management’s checklist

What Emergency Relief Options Should I Consider During the Coronavirus Pandemic?

Important Takeaways

For some taxpayers, the amount of income you earned in 2018 or 2019 will be significantly higher than what you will earn this year. Some of you may have even added a child in 2020. In both situations, individuals may not receive an EIP. But keep in mind that the EIP is a prepayment of a credit on your 2020 tax return. If you need to make adjustments, you will make them on your 2020 tax return. You will receive your payment as a credit when you file your 2020 tax return. This is unfortunate for those individuals who must wait an entire year for much need relief.

Coronavirus Distributions

Over the past couple of years, a natural disaster has either directly impacted us or someone we know. Depending on the severity, the federal government may have declared it a Federal Disaster Area. Many times, taxpayers living in these areas are provided tax relief by the IRS. The CARES Act provides a similar benefit to those individuals impacted by the Coronavirus.

IRA or 401(k) Distributions

Starting January 1st, 2020, you can take up to $100k (aggregate) per person from an IRA or 401(k). Ordinarily, any distributions prior to the age of 59 ½ incur a 10% penalty in addition to owing income tax on the distribution. However, the CARES Act temporarily waives that 10% for qualifying individuals. What is a qualifying individual? A qualifying individual is anyone who:

-

- has a spouse or dependent (generally a qualifying child or relative who receives more than half of his or her support from you) that has been diagnosed with COVID-19 by such a test.

- experiences adverse financial consequences as a result of being quarantined, furloughed, laid off, or having work hours reduced due to COVID-19.

- unable to work because of a lack of child care due to COVID-19 and experiences adverse financial consequences as a result.

- owns or operates a business that has closed or had operating hours reduced due to COVID-19 and has experienced adverse financial consequences as a result.

- has experienced adverse financial consequences due to other COVID-19-related factors to be specified in future IRS guidance.

How Will You Pay the Tax?

If you are eligible to take a Coronavirus distribution, you have two options as to how the distribution is taxed. You can elect to have the entire amount taxed in 2020, or you can have the income spread out over three years. Three years is the default. But for some people, it may be better to have the entire amount taxed in 2020, especially if they have recently been laid off and will have little to no income.

What If Your Situation Changes?

Let’s say you face some financial hardships and need to take a distribution from your IRA or 401(k). But later this year, you can secure another job that pays well. So well, that you have a little extra cash. If you have taken a Coronavirus distribution, you have up to three years to put the money back into the account. There is no rule as to how much or when you put the money back during those three years. Fair warning, though, if you repay your distribution, you will need to file an amended return(s) to reduce the amount of income you reported on a prior year’s return.

401(k) Distribution Quirks

401(k) plans play by a different set of rules. Although the CARES Act allows for up to a $100,000 distribution from your 401(k), you may or may not be able to take it. It all depends on your company’s plan. A recent survey indicates that fewer than half of employer plans are currently allowing Coronavirus distributions.

There is one last 401(k) quirky detail—mandatory withholding. Typically, when you take an early distribution from a 401(k), federal law requires an automatic 20% withholding for federal income taxes. However, the CARES Act has temporarily waived the automatic withholding requirements on Coronavirus distributions.

401(k) Loans

Many people are already aware that some 401(k) plans allow participants to take out loans. The maximum amount that you could take out was the lesser of your account value or 50% of your account. For instance, if your 401(k) had a balance of $60,000, the maximum loan that you could take is $30,000.

So, What is New?

For those individuals impacted by COVID-19, the CARES Act has increased the maximum loan limit from $50,000 to $100,000. It has also removed the percentage limit on plan loans made until September 23rd, 2020—180 days after the bill’s enactment date. But any existing loan amounts must be taken into consideration. In the example above, you would now be able to take a loan for $60,000. In addition to increasing the loan amounts, individuals impacted by the Coronavirus can delay loan payments due in 2020 for the rest of the year.

Tread Carefully

Although it may be enticing to take advantage of these higher loan limits, you need to exercise extreme caution. If you lose your job and you have an outstanding 401(k) loan, your loan will be due. The deadline to pay the amount back is the tax filing deadline (plus extensions) of the next year. Any amount not paid back is an early distribution subject to a 10% penalty and ordinary income taxes.

Required Minimum Distributions

The Coronavirus has caused most of the world’s economy to grind to a halt. As a result, markets around the world have crashed. Your IRA’s account value on December 31st, 2019 determines your RMD for 2020. For most individuals, their account values were higher at the start of the year than they are now. To help people from withdrawing funds will their account are down, the CARES Act has waved all Required Minimum Distributions (RMDs) for 2020.

Procrastinators Rejoice

The CARES Act states that if you have not yet taken your RMD from your IRA or your inherited IRA for 2020, you don’t have to. The CARES Act goes even one step further. It says if you were 70 ½ last year and you delayed taking that distribution until this year, you can skip that one too.

But what if you already took your RMD? Unfortunately, the CARES Act does not make any provision for this occurrence. However, there may be some relief. If it has been less than 60 days, you may be able to roll that amount back into your IRA. The process is known as a 60-day IRA rollover.

A couple of caveats here. You are only allowed to do one 60-day rollover every year (365 days). So if you made multiple distributions within the last couple of days, you would only be able to roll one of them back in. The 60-day rollover applies to any IRA to IRA rollover. It does not apply to an IRA to 401(k) or 403(b) rollover. Remember that if you are a non-spouse beneficiary, you cannot do a 60-day rollover.

Should You Take Your RMD Anyway?

This depends on your situation. Some individuals may need the money and have no other choice. One thing to keep in mind, we are currently at historically low income tax rates. For some individuals, it may make sense to continue to take distributions as scheduled. For others, the answer may be a little more complicated, depending on how much their Social Security is taxed. If you are in a situation where taking your RMD will make a greater percent of your Social Security benefits taxable, it could make sense to delay that distribution. And for those retirees who run into problems with the Income-Related Monthly Adjustment Amount (IRMMA) thresholds causing them to pay high Medicare premiums, it may make sense to make some adjustments.

Conclusion

The financial destruction that the Coronavirus has caused our economy is simply unprecedented. It has impacted every individual in one way or another. Although it is far from perfect, the CARES Act does help to address some of the financial concerns facing people today. By knowing the details of the legislation, perhaps it can make a difficult financial situation a little easier to handle. And if it isn’t applicable to you, maybe this information can allow you to help someone you know.

Click here to learn more about how Hedgefield Wealth Management can help to remove the burden of managing your wealth.

Hedgefield Wealth Management is a registered investment adviser. Hedgefield Wealth Management does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.